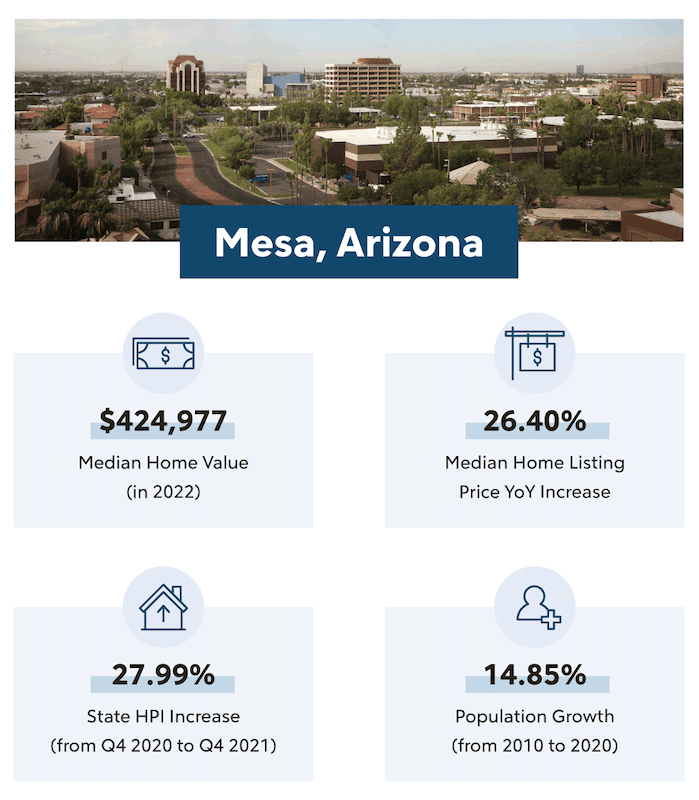

1. Mesa, Arizona

- Median Home Value: $424,977

- Median Home Listing Price YoY Increase: 26.40%

- State HPI Increase (from Q4 2020 to Q4 2021): 27.99%

- Population Growth (from 2010 to 2020): 14.85%

Mesa’s population growth can be attributed to its sunny weather and booming economy. It has parks, lakes and forests, making it a great home for outdoor enthusiasts. Since it’s within driving distance of Phoenix, residents can strike a balance between small town and big city lifestyles.

In April 2022, 60.1% of Mesa’s homes were sold above asking price, showing that its housing market is on the rise2. From April 2021 to April 2022, Mesa’s median housing prices rose by over $88,000.

With its increasing population and appreciating home prices, Mesa is on track to becoming a major city.

2. Phoenix, Arizona

- Median Home Value: $409,925

- Median Home Listing Price YoY Increase: 26.00%

- State HPI Increase (from Q4 2020 to Q4 2021): 27.99%

- Population Growth (from 2010 to 2020): 11.24%

While Phoenix is regarded as a great place to retire, its growing population and strong economy makes it equally attractive to younger professionals. Since Phoenix is close to tourist destinations like the Grand Canyon, Las Vegas and Sedona, there’s never a shortage of opportunities for day trips.

The median price of Phoenix homes increased by more than $84,000 from April 2021 to April 2022. Out of the homes sold in April 2022, 62% were sold above asking price2.

This means that if you’re shopping for a home in Phoenix, you should target homes slightly below your budget so you can increase your bid if necessary.

3. Raleigh, North Carolina

- Median Home Value: $371,682

- Median Home Listing Price YoY Increase: 25.20%

- State HPI Increase (from Q4 2020 to Q4 2021): 20.70%

- Population Growth (from 2010 to 2020): 15.79%

Raleigh is a growing hub for younger professionals. Its unemployment rate is lower than the national average at 2.9%, and there are plenty of job opportunities in the mining, logging, transportation and construction industries.

Raleigh’s median housing prices increased by over $74,000 from April 2021 to April 20222. This steep increase suggests that it’s a great opportunity for Raleigh residents to sell.

See the whole list … https://www.quickenloans.com/learn/hottest-real-estate-markets

Buying, Selling or Investing?

Choose local real estate professionals to assist you with all your real estate needs. contact us today for market information, community guides, local lender resources and Fair Market Value report on your current home and analysis of property you wish to purchase.

STEER CLEAR OF “iBUYERS”

The term iBuyer or All Cash Buyer is now synonomous with WHOLESALE! Period.

A lot of press has been given to these all cash buyers making false promises that include “Full Market Value”. This is an outright lie preyinmg on desperate sellers. There is only ONE WAY to recieve Full Market Value and that is on the open market where consumers make offers based on the current market conditions. The average iBuyer LOST more than 12% of their hard earned equity to investor buyers last year.

It’s Your Equity, Don’t Give it away! A good starting point is a free home valuation AKA a CMA

©2024 Home1Realty | Real Estate. Your Way. | Privacy Policy

#FSBO #ForSaleByOwner #listyourhome #MLSlisting #getonMLS #FlatRate #RealEstate #Realty

#1PercentListing #sellYourHome #SaveThousands #Save1000s #1%Realty #DiscountBroker

#HomeSeller #HomeBuyer #Home1Realty #homes #ForSale #LocalRealtor #FullService

#DiscountService #franchiseRealtor #FranchiseBroker #RealEstateYourWay #YourWay

#sellityourself #openhouse #sellersGuide #FAQ #BuyerQuestions #SellerQuestions

#NETworksheet #Title #escrow #Closing #StewartTitle #TitlePolicy #ForSaleSign